6 December 2018

Friends! I’ve missed you! This may be the latest in the month I’ve ever posted a goals post in my many years of doing them, but gosh darn it I’m here! :)

Since going back to work at the end of October, we have essentially had house guests 24/7 as our parents took turns watching Shep during the day. We have also traveled 3 of the 6 weekends between then and now, and John, June, and I all came down with a 24-hour stomach bug this past weekend. Combined with a busy season at work, the holidays, and John starting a new job (!), I’ve felt a bit like I’m just keeping my chin above water. On any free evening I do have, it seems by the time I’ve taken care of my necessary tasks to keep our household running, it’s 10:30 and time to get ready for bed. This is unusual for me, and honestly it’s been frustrating. There’s been no time for reading and no time for writing, and I’ve felt the lack of both.

All this to say – thanks for sticking with me! I am hopeful that I’ll be able to share a few posts before the year is over (I’ve got so many brewing!!), but even if not, I know 2019 will be a fresh start.

But let’s not get ahead of ourselves :)

On my calendar this month:

— Dinner out with John for our 2018 review and celebration – one of my favorite nights of the year!

— Christmas in Connecticut, complete with a Polar Express train ride with matching cousin jams!!

— A low-key New Year’s Eve dinner and board game night with neighborhood friends

What I’m loving right now:

— We’re trying the Crew + Co Advent cards for the first time this year, based on the beloved Jesus Storybook Bible. I think June is still a bit young for the practice, but I’m enjoying it :)

— Listen, if you enjoy the government/action/conspiracy genre (only my favorite genre of them all), you MUST watch Bodyguard on Netflix. It’s six episodes and you will be on the edge of your seat the whole time. SO SO SO GOOD.

— You all know and love my friend Nancy (she of How We Do It fame), so I wanted to make sure you knew about her new blog! I’m as eager as you to learn from her, and can’t wait to see what she has coming down the pike.

What I read in November:

— Still plugging away at The Coddling of the American Mind (see above). If you’d like more recommendations in the meantime, I’ve rounded up my favorite fiction and non-fiction picks for your perusal!

Revisiting my goals for November:

Write one thank you note per day (Only got through about 15 notes, but it was a great practice!)

Organize our loft (Uhhh no. Moving this to my yearly goals because it clearly needs a more expansive plan.)

Do lots of Christmas shopping, taking advantage of Black Friday sales (Oh yes.)

Share gift guides for ladies, gents, parents, and kiddos (Wish I could have gotten more of these together earlier, but they take hours to research and write! Would you still be interested in seeing the last two, even though Black Friday is over?)

Order Christmas cards and Christmas newsletter (Christmas cards ordered and received – they look so good!!)

Work on Shep’s baby book and update June’s

Take down June’s pelmet and replace with curtains, creating a reading corner

December goals:

— Set our 2019 budget

— Finalize and print our yearly newsletter and send out our Christmas cards with love

— Work on Shep’s baby book and update June’s

— Share the story of Shep’s birth

— Send out invites for June’s birthday and order supplies

— Love on our trash and recycling guys, our neighborhood friends, and June’s teachers

Friends, I’d love to hear: do you do anything special for the folks who help make your life run smoothly, like the ones I listed above? I’m always looking for good ideas, though peanut butter balls are perennially a must.

P.S. On the subject of goals: I’m sharing bits of my PowerSheets prep work on Instagram this week, and it has been fun! Would love to have you join me!

Affiliate links are used in this post!

read more

23 May 2018

Three years ago, I wrote a post about preparing financially for a baby (my most-requested Marvelous Money topic at the time!). I promised in that post to revisit the topic at some point in the future when I actually had children, and I’m so happy to do so today! My angle: what it actually cost us to add a baby to our family in the first year.

Several of you have shared that you think of me as a “big sister” going a few steps ahead of you, which is wonderfully sweet and a title I take seriously. I want to share these numbers not because you’ll be able to copy and paste them into your own life, but because if you’re thinking about having children and wondering how it will affect your finances (hand of my younger self raised high!), it is incredibly hard to find useful numbers.

I hope this post offers some hope, helpful perspective, and fodder for conversation with your spouse! :)

First, a few details about the parameters I chose:

— Our daughter was born in January, which is excellent for sharing numbers, since we budget every dollar on an annual basis. I’ve included all of the June-related costs from 2016 here (unless otherwise noted), as well as the June-related costs from 2015 that we incurred while preparing for her arrival.

— I have not included the retail price of gifts we received, items we borrowed, etc. here — just what we actually paid out of pocket. Obviously, there is a HUGE range of prices for everything baby-related, and it can make a big difference how much you buy used or buy at all. This is not meant to be a universal cost breakdown but just a glimpse at one family’s expenses based on our unique circumstances and priorities.

— I did not include any healthcare costs, as those were paid for by savings in our HSA and I don’t consider them “out of pocket.”

— I did not include “shelter” costs (i.e. our mortgage) or transportation, since we would have had those anyway. I also did not include any portion of our grocery budget, because it did not change in June’s first year with us.

That should cover the preliminaries! Here’s the breakdown, with explanation following…

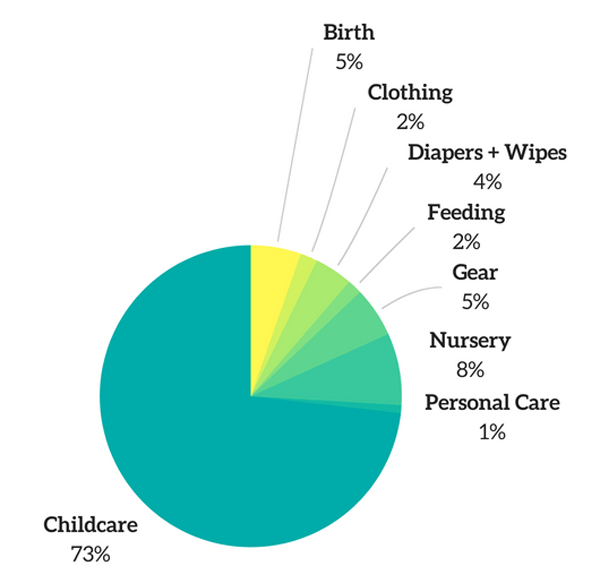

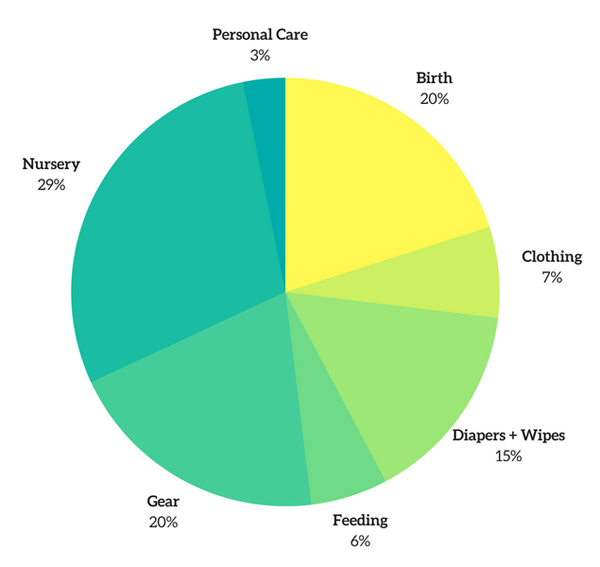

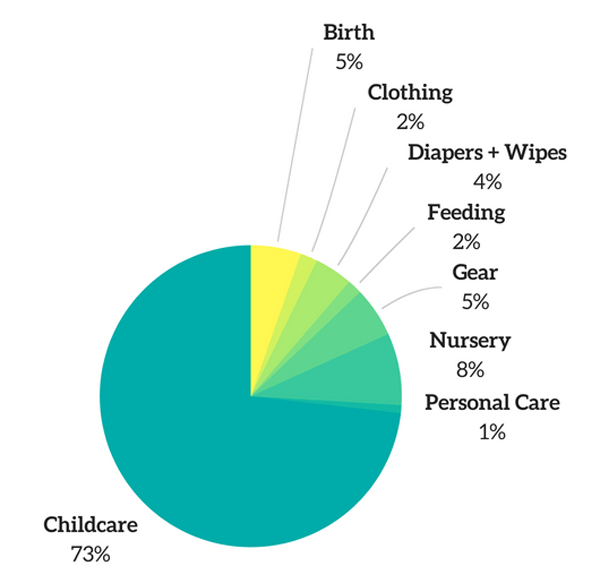

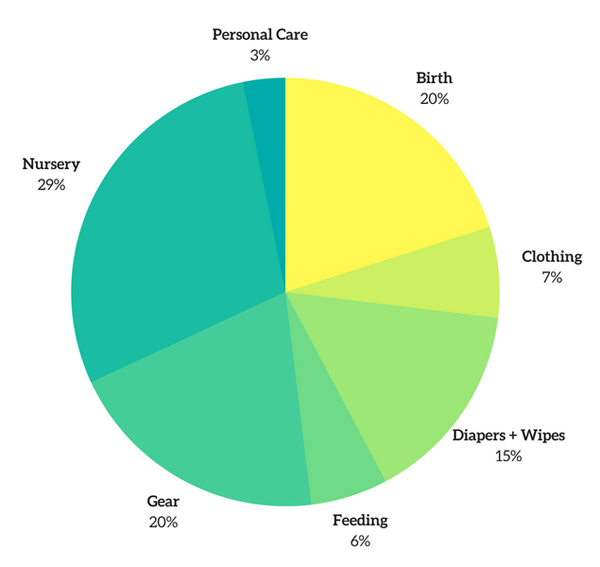

Birth: This included our birth class and our doula.

Books: I bought four pregnancy and parenting books – my favorites are here!

Childcare: This is by far the largest portion of the total, but I have not even an iota of regret about spending this money! There is almost nothing I would rather spend on than making sure June is safe, loved, and well cared for when we’re not with her, and we were so happy with the school we sent her to for her first year. This covered about eight months of care post-leave.

Clothing: We were incredibly lucky to receive LOTS of hand-me-downs from Nancy and my sister. The majority of the rest of June’s clothing was purchased at my favorite twice-a-year consignment sale, with a few additional special items here and there. I think this is a category where we saved a lot of money, especially considering we had a girl – ha!

Diapers and wipes: We almost exclusively used Water Wipes and Up&Up diapers and were very happy with both.

Feeding: This included our Kiinde supplies and some formula. Thankfully, breastfeeding dropped this category wayyy down!

Gear: This category included everything that we didn’t borrow or receive as a gift, including our baby monitor, our bassinet, a console for our stroller, a convertible car seat, baby gates, and more. You can read about some of our favorite gear at different ages in these posts!

Nursery: This was the only category whose total surprised me a bit, but we did have several large expenses that added up! The good news is that these purchases were the LEAST important, so they could easily be forgone if you’re on a tight budget. Larger purchases included the light fixture ($120); the glider, fabric, and upholstery ($475); a quilt for the twin bed ($110); and the Liberty fabric for the crib skirt ($154 – that stuff ain’t cheap!).

Personal care: This category included diaper cream, Nose Frida supplies, burp cloths, a thermometer, body wash, toothbrushes, and other toiletry type things!

Toys, gifts, and fun: Thankfully, babies don’t need too much to have fun :) This category included her beloved action stackers, a few books (we received SO many as gifts!), cups and a ring stacker, and the ukulele we got her for her first Christmas.

If you’re a visual person, here’s the breakdown in pie chart form:

And one with the major categories besides childcare:

There you have it! If you’d like to share, I’d love to hear how our breakdown stacks up to your own spending, or where you were able to save if you also have a sweet baby! Thank you, as always, for being so kind and thoughtful, friends!

Affiliate links are used in this post!

read more

24 April 2018

As I wrote the How We Do It series, there were many topics – big and small – that I knew I would want to revisit at some point in posts of their own. When I got a few questions about how we jointly manage our finances in this post, I knew it was a great one to start with!

Using this beautiful image from Cultivate What Matters of the new Finance Goal Guide, launching today! If you have money goals you’re working toward, I think you’ll love this product!!

Many of the questions centered around why John and I have separate checking accounts. The short answer is that there’s no good reason – ha! Here’s the longer answer:

John and I have separate checking and savings accounts because we opened them before we were married, and there didn’t seem to be any good reason to open a new joint one after saying “I do.” After all, our accounts are at the same bank (and linked, so that we can access each other’s through our own dashboards!), and we of course have each other’s passwords. All accounts opened since our wedding day have been joint ones.

I know many people have strong opinions on joint versus separate accounts. I think many of the opinions, though, stop short of what’s truly important: the state of your heads and hearts trumps the practicalities of how your accounts are set up any day. All of the joint accounts in the world can still lead you to a dead end if you’re not pulling in the same direction.

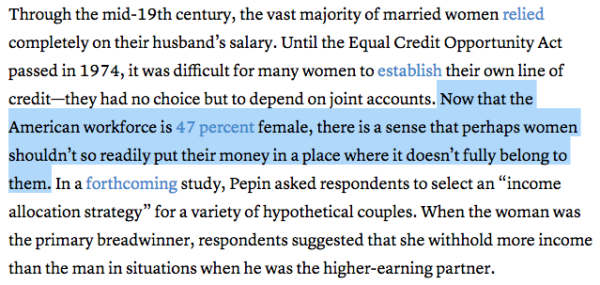

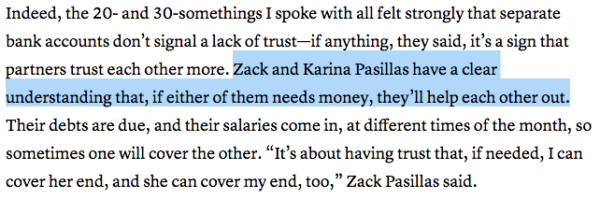

There is no “his money” and “her money” in our marriage. We have never valued each other or set individual spending levels based on what either of us make at our jobs. The idea of spouses effectively living at different income levels within a marriage is shocking and sad to me, as described in this recent Atlantic article:

They’ll help each other out?? Marriage means joining your financial future just as surely as it means joining your lives. I supported both of us while John searched for a job, and he put money toward my student loans for years without a peep of complaint. Were one of us to lose our job, we would not receive a “handout” from the other person – we would both adjust and bear the burden together.

On a practical note, the main reason there is no “his” or “her” money is that ALL money is fed into our family budget. At that point, we simply have one lump sum of money that we need to decide what to do with, together – it literally no longer matters who brought in how much. Because we’ve set the budget together, if it says we have a certain amount to spend, then that’s how much we have to spend. A budget is a great equalizer in this way, and if you need yet another reason to get on the budget bandwagon, there you go! :)

But back to the Atlantic article:

To that I would say, I don’t believe the money I bring home does or should “fully belong to me” — it’s shared with my husband, just as his money is shared with me.

Unsurprisingly, the arguments in the Atlantic article for why a couple wouldn’t merge their finances aren’t that compelling to me. There is one argument that I think does have validity, at least at the outset, but I don’t think it’s a situation that’s tenable longterm for a healthy marriage. If the two of you don’t have aligned beliefs on money, and aren’t consulting each other on where you’re hoping to go in life, then merging your finances absolutely will be a mess and will lead to arguments. The solution, though, is not to keep things separate — it’s to do the work to get on the same page.

John and I have a bit of an advantage here because we formed our thoughts on money alongside each other, but we also work actively to make sure we stay on the same page. (Hence our regular conversations and bimonthly net worth meetings!). Our friends Nancy and Will found themselves in the opposite situation: they came into marriage with VERY different ideas about how money should be managed. Financial Peace University helped them reach common ground, and they are some of the most inspiring financial stewards we know!

A final note, should you need more convincing: a joint budget not only determines your day to day spending on groceries, clothing, lawn care, and more, but it sets and guides your financial big picture, like how much you’re saving for retirement, how soon you’ll be able to get out of debt, when you’ll squirrel away the amount for a down payment goal, or how much you can give away each year.

And those big picture things? You want to work on them together, because then you will succeed together (and a lot more quickly than if you were working on your own!). There are few things more unifying in a marriage than reaching a major goal together, and if you’re not merging your finances, you’ll miss out on them.

Whew! Clearly this is a topic I’m passionate about, and that Atlantic article brought it all bubbling to the surface! To finish up, I’d love to hear: what goal are you working toward in your finances right now?

read more

27 March 2018

Friends, first of all, thank you so much for your heartfelt comments on my last post. Each one meant so much to me, so thank you for sharing! I love you all! Now onto the business of today…

We talk often at my job about how our greatest frustrations can turn into our greatest passions, and sometimes (if we’re lucky), even our life’s work. I had a bit of a light bulb moment a few weeks ago, and thought I’d share it…

One of my greatest frustrations is seeing women accept conventional wisdom and societal truisms as being true for their lives, even if they are not or don’t have to be. So often, I think we just accept things because we hear other people or our parents or our friends or TV anchors or newspaper columnists say them enough times — so they must be true.

And sometimes they are. But I believe they don’t always have to be. Instead of bending this way and that with the winds of everyone else’s paths and opinions, we CAN be confident in the life we’re living and the priorities where we’re planting our flags. It takes a firm foundation and an inner surety to be able to do this in the face of an entire culture (and sometimes very real people in your life) telling you you should second guess everything and just go with the flow, but it can be done.

You all helped me see in your survey responses that confidence is what we’re doing here. Hopefully, through sharing my story, I can show you that it’s okay to live your own path kindly, purposefully, and simply, without fanfare or fluster. I am capable, and so are you. Here are some of the lies we’ve sidestepped here together:

If you’re good at something, you need to find a way to make money doing it.

I’ll never pay off my student loans.

Emotional labor is a burden and a curse.

Time flies by so quickly.

The only way you can have a job you love is to work for yourself.

Mom guilt is unavoidable.

I wish I could give my children the childhood I had, but the world is different now.

If you find Em for Marvelous to be a breath of fresh air (as many of you so kindly worded it in your responses), I hope it’s because you leave feeling built up and inspired to walk your own path, not necessarily to follow mine.

As I said at the beginning of the How We Do It series, I don’t have all the answers, but one thing I have been given is a confidence in the decisions I make for myself and my family, and a willingness to share them. Confidence can be as infectious as guilt, shame, or uncertainty, but it’s much, much better to spread. As I wrote down at the last Making Things Happen Conference, my life’s work is to equip and empower women to see that they are capable, and this blog is a large part of that. I’m so glad you’re here.

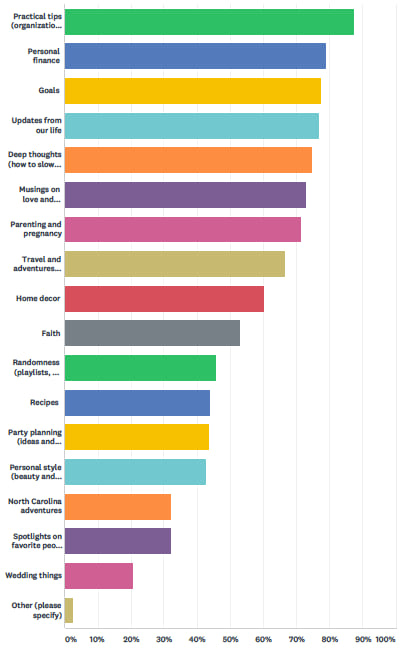

Which brings us to our survey results! As of last week, I clocked 250 survey responses, and figured that was a nice even number to cap it at for this year! Some of you asked to see the results, so here’s a bit about your fellow readers…

— A fifth of readers have only been reading for a year. BUT, more than half of you have been reading for five or more years, which is pretty incredible!!

— 70% of you found EFM through my work, for which I am so grateful!

— The majority (73%) of you are married.

— Most of you have a “traditional” job, which I love. I would consider my job to be traditional (and awesome!), as well.

— 87% of you are between the ages of 23-35. The most common age split was 27-30, just younger than me, which makes a lot of sense given a common theme in the open-ended responses: that you consider me something of a big sister, often one step ahead of you in life.

— About half of you don’t have kids! That really surprised me. But, you still like parenting posts, as you’ll see below! Also, congratulations to my 13 pregnant readers :)

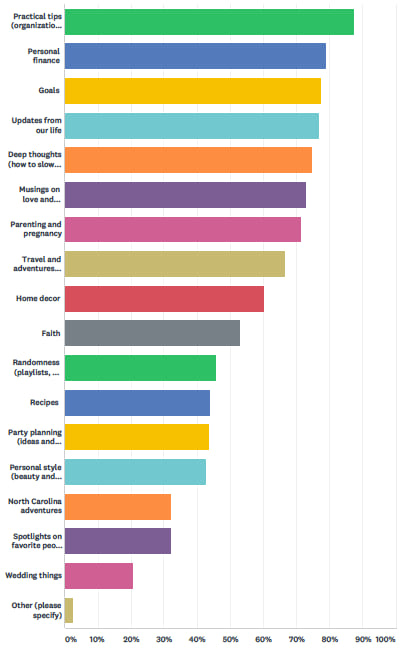

One thing that came up over and over is that y’all like the variety of content I share, which is nicely demonstrated by this data. Nearly all of you chose practical tips as a favorite topic, with finance coming in a close second. (The How We Do It series and Marvelous Money posts were mentioned almost unanimously as favorites in the open-ended section.) I’d also consider goals, life updates, deep thoughts, love and marriage, and parenting and pregnancy in the top tier.

This question is one of my favorites, because though I’m never going to write about anything I’m not passionate about (this is just a hobby for me and I like to keep it fun!), I have pages and pages of potential topics. Hearing from y’all and learning more about you helps me decide which of those topics to move to the top of the list, which is great for both of us! :)

Once again, you all were uniformly kind and encouraging in the open-ended responses. Words you used to describe EFM included real, relatable, honest, intentional, simplicity, inspiring, positive, normal, practical, calm, sincere, and encouraging. My favorites were “real” and “normal” :) More:

— This comment summed up probably the strongest theme: “EFM is a breath of fresh air in a space where many blogs focus on more materialistic things to bring happiness. When reading your blog, I come away with practical and meaningful things I can do, rather than buy, to improve myself and my life.” That is the beauty of writing for love rather than money, I think – you’re just getting my real life, complete with real budget. As another one of you said: “Your blog feels like it’s about authentic living for real people: people who have jobs and families and budgets but want to slow down, find joy, and still be an adult.”

— Many of you commented that you love keeping up with my family, and also that you appreciate my boundaries (and a few asked about how I keep them strong). I think there’s a post in the future there, because unsurprisingly it’s something I’m passionate about!

— Possibly my favorite comments came from the women who shared that we are different in significant ways (maybe they don’t share my faith, don’t have kids, don’t live in the South, have a totally different job, etc.), but that they still love reading EFM. In a world where it’s so easy (and common!) to tune out anyone who’s different from you, that feels like some of the most gratifying feedback.

Anyway, I hope that peek into the survey results was interesting! And that my soap box speech wasn’t too intense, ha! Again, I’m so, so thankful for each one of you, and especially for you sharing your thoughts with me. Together, we make this a sweet spot on the internet :)

I would love to hear: do my thoughts on confidence resonate with you? What are some of your greatest frustrations?

All photos by Nancy Ray from our family session

read more