Marvelous Money: Charitable Giving Accounts

I came across a book review over the weekend that reinforced a lot of things I (and you) probably already know, but that bear repeating. An excerpt:

A team of researchers at the New York State Psychiatric Institute surveyed 43,000 Americans and found that, by some wide margin, the rich were more likely to shoplift than the poor. Another study… revealed that people with incomes below twenty-five grand give away, on average, 4.2 percent of their income, while those earning more than 150 grand a year give away only 2.7 percent. ‘As you move up the class ladder,’ says Keltner, “you are more likely to violate the rules of the road, to lie, to cheat, to take candy from kids, to shoplift, and to be tightfisted in giving to others.’ There is an obvious chicken-and-egg question to ask here. But it is beginning to seem that the problem isn’t that the kind of people who wind up on the pleasant side of inequality suffer from some moral disability… The problem is caused by the inequality itself: it triggers a chemical reaction in the privileged few. It tilts their brains. It causes them to be less likely to care about anyone but themselves or to experience the moral sentiments needed to be a decent citizen.

Or even a happy one… In a forthcoming paper, Norton and his colleagues track the effects of getting money on the happiness of people who already have a lot of it: a rich person getting even richer experiences zero gain in happiness. That’s not all that surprising; it’s what Norton asked next that led to an interesting insight. He asked these rich people how happy they were at any given moment. Then he asked them how much money they would need to be even happier. ‘All of them said they needed two to three times more than they had to feel happier,’ says Norton. The evidence overwhelmingly suggests that money, above a certain modest sum, does not have the power to buy happiness, and yet even very rich people continue to believe that it does: the happiness will come from the money they don’t yet have. To the general rule that money, above a certain low level, cannot buy happiness there is one exception. ‘While spending money upon oneself does nothing for one’s happiness,’ says Norton, ‘spending it on others increases happiness.’

It’s become something of a tradition for me to post on the theme of generosity each December. Generosity is very close to my heart; it’s what I want my heart to be. I believe in acts of kindness and in giving away money at Christmas. But I hope I haven’t given the impression that generosity is something that’s reserved for one month of the year.

Even as we work hard at saving for retirement or getting out of debt or budgeting, I think we should be working equally as hard on giving away money. To me, a person with truly healthy finances would have her spending, her saving, AND her giving all on track. As we get better at spending and saving, the hope is that we will become wealthier. The hope is not, as the review describes above, that we would become empty, selfish, and small. And that’s where giving comes in – it makes us bigger, better, more caring, and less selfish people.

Even so, it’s not always easy. In 2015, we have budgeted to tithe, the first time we’ve done so fully. While this is exciting, to be honest, it has also been – ahem – refining. I find myself saying, God, you know we are responsible with money. You know we would use that money for good things – to save, to pay off our mortgage. We wouldn’t waste it! Can’t we just keep a little more? Frustrating though it may be, ultimately I know that the discipline is important. It reminds me that our money is not our own, that I must decrease, that the world does not revolve around me (all things I tend to forget). With all of the blessings in my life, it behooves me to feel a pinch somewhere – in this case, when I part with that offering every week.

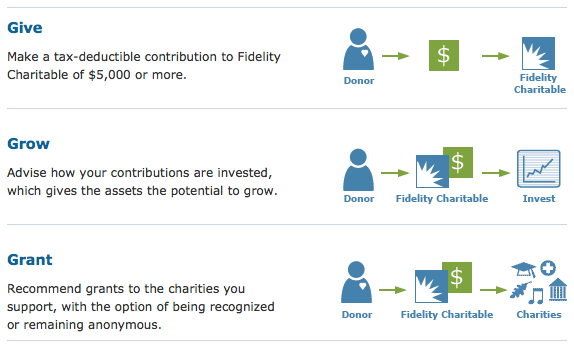

So how do you give away money? It seems like it would be pretty simple (Here’s $100 for you! And $100 for you!), but just as with other aspects of your finances, there are things to learn and consider. This year, we decided to open a donor-advised fund to facilitate our giving. This graphic helps explain what one is, using Fidelity’s fund as an example:

Basically, you make a tax-deductible donation to the organization of your choice. Your money is no longer your own (it’s been donated), but it is held for you with your name on it. You can then “direct” or “recommend” (organizations use different terminology, but they do as you request :) ) “grants” to charities, churches, and non-profits. For example, we donate the full amount we’ve pledged to our church to our donor-advised fund, then direct the fund to give monthly grants to our church.

There are several benefits to using a donor-advised fund:

1. It simplifies your giving for taxes and recordkeeping. As you can see above, instead of donating directly to the charities you support, you give all of your money to your donor-advised fund. At that point, in the eyes of the IRS, your tax-deductible donation has been made. So, when your tax return is due, you only have one form and one lump sum – say, $10,000 – to submit, even though you gave $1,000 to ten different charities over the course of the year.

2. It helps keep giving a priority. If you’re not very strict with your budgeting, it can be easy to spend money that you meant to give away. With your donor-advised fund, you can move the money out of your normal accounts and keep it in a safe place, even if you don’t know yet where you’d like to donate the money.

3. You can invest the money. In many funds, while your money is waiting, it can be invested (and professionally managed – usually in a mix of stocks and bonds), and potentially grow – meaning more money to give away to charity!

Think a donor-advised fund might be for you? I know of a few organizations to look into, including Fidelity Charitable, Vanguard Charitable, and the National Christian Foundation.

I’d love to hear: do any of you use a donor-advised fund? Is giving a part of your budget? Is it something you think about often, or just in months like December? I’m all ears for questions, too!

Em — you do my heart good.

This is such useful advice! I love that our generation is sharing about finances! So important, and the giving aspect is equally as important! Thank you!

@Rob and @Paige – love you guys! :)

Hi there! Great post, and something my husband I are very interested in. Could you please speak to any fees associated with opening a Donor Advised Fund or contributing through one? Thank you!

Love this post and your blog! I am trying to give away as much as I spend on Christmas gifts this year (inspired by it being one of your goals!)- it is proving to be tougher than I thought, but has helped me keep the season in perspective!

@SK Even if it’s not the full amount, it’s still great! Proud of you!!

@Bridgette Hello! The company we use charges a $100 annual fee or .6% of your balance, whichever is greater. There isn’t an opening fee but you do have to make an initial contribution of $5,000. This seems to be competitive with the options out there, and has a lower initial contribution amount than many! Feel free to shoot me an email if you’d like more info :)

I’ve never heard of this but it is so interesting! I’m definitely going to look into it more for us!

This is really interesting. We have a “Kingdom fund” established where each month we give $100 to someone/organization who we see is having a particularly hard time or is doing good work for God’s kingdom. While we have committed to giving this away, it is hard to track that outgoing donation. Do you know if there is a way to use the Donor account to give to individuals or is it only non-profits?

[…] grant that money to the charities that you designate (subject to approval). My friend Em has a great post about donor-advised funds. This doesn’t allow you to do small, personal giving with the money, […]