Marvelous Money: The Financial Implications of Having a Third Child

Editor’s note: I wrote most of this post when I was still pregnant with Annie (!). It’s sat in my drafts folder for more than two years, waiting for me to come back and finish it up. Today is the day! I decided the best thing to do would be to publish my original speculative thoughts and then add a little two-years-in update with how things have actually turned out (so far). I hope it’s helpful!

There were a number of topics I knew I wanted to discuss once the news was out about baby number three. There was deciding to have a third baby at all, of course, as well as the pros and cons of another boy or girl. But one I was really looking forward to? The financial implications of having a third child. We’ve discussed the intersection of money and kids a few times (here and here most specifically!), and I find it an endlessly fascinating and severely under-discussed topic. So, consider this post one part sharing our personal experience, one part encouragement, and one part practical strategizing. As always, I can’t wait to hear your thoughts. Let’s dig in!

Though each additional kiddo in a family introduces a new element to the financial picture, I think a third child is unique in a way a second or even a fourth is not. I thought I’d walk through a few common kid budget categories to share how we thought through them, and a few things you might want to think about if you’re considering having a third. I hope this post offers some hope, helpful perspective, and fodder for conversation with your spouse! :)

Housing

Let’s tackle a big one first! People have been curious from the beginning as to where baby sister will sleep. Our home has four bedrooms, so theoretically we have a room for each kiddo and one for John and me. However, it’s important for us to maintain a guest room, considering that we have frequently-visiting family who lives far away, so as I explained here, we’re planning to keep our guest room intact and add a crib to it. This should hold us for at least two years, at which time we can decide if we want to house two of the kids together, officially designate the guest room as baby sister’s room (but keep the big bed for guest visits), or consider a move to a larger home. I shared a room at times growing up and would have no problem with that scenario.

Bottom line: For us, baby number three won’t add any additional cost to the housing line in our budget. Regardless of whether we had a third child, we likely would have considered moving in a few years, anyway, so I’d consider this category a wash.

Update two years in: Annie is still going strong in the room previously known as the guest room! We’re hoping she’ll last another year in her crib before transitioning to the queen bed. June is also keen for the two of them to share a room, so we may consider bunk beds in the future. No immediate plans to move :)

Transportation

Another big one! Many people find a third child pushes them over the edge to a larger car, either to get a third row of seating in an SUV or to switch to a minivan. Obviously, this can be a huge expense.

Our take: Currently, we have a Kia Sorento. We love it! It’s a small three-row SUV, but it does not have captain’s chairs, so there’s no easy way to get to the third row of seats with two car seats installed in the middle row (i.e. they can’t slide forward with the car seats installed).

To accommodate a three-child family at our kids’ ages, we have a few options. We could invest in skinnier car seats that would fit three across. This is what Nancy did to fit three kids in their Highlander, using the Diono car seats. They’re pricy, but less than buying a different car.

Or, we could have June climb in through the back lift gate or clamber over the second row of seats. She does not mind these options – in fact, she kind of loves them – but they’re not the most practical for things like carpool pick-up lines or when we’re traveling and have the trunk packed full.

Bottom line: We will almost certainly upgrade to a larger SUV with captain’s chairs at some point in the not-so-distant future. We have our eye on the Kia Telluride. This will be a big expense that we may not have incurred if we had stayed at two kiddos, but we’re thankful to have socked away money for this expense over the last few years and plan to pay cash. Also, it’s nice to know we could do just fine with our current ride and can make this change on our own time table.

Update two years in: We placed an order for a Telluride two months before Annie was born and received it four months after she was born! Big, big Telly fans over here.

Childcare

The final biggest immediate expense! Anecdotally, I feel like the change from two to three children is when many couples feel that it no longer financially makes sense for both parents to work outside the home and pay for three kids to go to full-time childcare. Of course, this depends greatly on the age gaps between your kids and what option you choose when they enter elementary-school age.

Our take: The spacing of our children makes this not as burdensome as it could be. June will move on to public school kindergarten shortly after Annie is born, but we’ll replace the cost of her preschool with a higher rate to send an infant to daycare (in our area, this ranges from about $1,300-$1,600 per month, which is about twice what we pay for June’s preschool as a five-year-old).

Bottom line: Our childcare costs will go up slightly in 2022, but we will never need to pay three childcare costs at the same time. That would require a much bigger adjustment to the budget.

Update two years in: We made it through the most expensive year! Annie has now joined Shep at their Montessori preschool, where her tuition is less than we paid at daycare. Yes, we will be paying childcare for more years than we would have if we had stopped at two, but our budget is used to it at this point and so it doesn’t really require any additional rejiggering.

Gear

Some good news! By the time most people get to their third child, they have all of the basics covered: cribs, car seats, toys, high chairs, etc. Of course, some items may be a bit worn at this point and need replacing, but for the most part, for most people, this category should not need to add much to the budget.

Our take: This jives with our experience! We will be reusing our crib, crib mattress, car seats, stroller, travel bassinet, and more. The bigger items on our list: a stroller fan (our first one died and it’s a must for a summer baby!), a few more silicone bibs (many of ours have ripped or cracked at this point), Kiinde pouches (they’re one-time use), another hooded towel, another sound machine, and a new trike. (Our two older kids used and loved the same one that was handed down from a neighbor, but the wheel constantly comes off its track and considering how much we’ve used our first one, it would be well worth the purchase!) We’ll also buy new sheets, a muslin lovey, a few stuffed animals, and a nap quilt – sweet things chosen just for this baby girl.

Bottom line: We expect our expenses to be minimal in this category, especially because I’ll look to buy whatever possible secondhand if we don’t receive it as a gift. (I’m planning a gear redux post sometime soon, going into more detail over what we plan to reuse or try new this time around, so stay tuned for that.)

Update two years in: We had to replace our infant car seat because our original had expired, but otherwise this tracks! We were grateful to receive several of the items I listed above as gifts, so the only significant cost was the Kiinde pouches for a year of breastfeeding and pumping. Also, I did manage to write part one of that gear redux post – part two coming soon :)

Clothing

Though this is a category in which it’s easy to get carried away, the good news is that between hand-me-downs, Buy Nothing groups, and consignment sales/stores, it’s also easy to keep your costs relatively low! Of course, if your third child is the same gender as one of your first two kids, this becomes even easier (though clothes do wear out, and more frequently as kids get older – I’ve retired hardly any of June’s leggings this year, as it seems they all have massive holes in the knees!)

Our take: I cannot WAIT to see baby sister in some of our favorite June hand-me-downs!! One of the best parts about having another girl, in my opinion! Between all the clothing I’ve saved from June’s wardrobe and my sister-in-law generously sending along bags of goodies from her two summer-birthday girls, there is nothing we need to buy for at least the first two years. Yahoo! Of course, I’m sure I’ll buy a few pieces here and there just for fun, and certainly more as she gets older and more aware/independent.

Bottom line: Negligible cost at first; will need to build more room into the budget as she gets older and we’re generally clothing three kids instead of two. But again, I cannot emphasize enough the power of buying secondhand!! It’s like magic.

Update two years in: Yep! I can probably count on two hands the number of (secondhand) clothing items I’ve bought for Annie so far, and though it’s hard to resist the cuteness, seeing her in my favorite June pieces helps to scratch the itch :)

Diapers and Wipes

As these are consumable items, you can expect to pay roughly what you paid for any other child – it doesn’t matter if it’s your first or fifth. (Cloth diapers, of course, would be a different story and certainly an opportunity for cost savings over multiple children!)

Bottom line: Yep, these will need to be factored into the budget. However, it’s nice that June is completely out of diapers and pull-ups and Shep is only wearing nighttime pull-ups at this point!

Update two years in: No surprises here! Again, I’m thankful the spacing of our kids allowed for more breathing room in this budget category.

Ongoing Activities

Looking a little farther down the road, a third child does mean we’ll need to increase our budget for the routine costs and “fun” expenses associated with kids – birthday and Christmas presents, sports equipment and class fees, summer camps, tickets to events, expanding family museum memberships, adding an extra person to meals out and vacations, etc.

Bottom line: Yep! For us, this feels like one of the bigger factors when considering the financial implications of a third child. Yes, daycare costs might loom large immediately, but over the long run, this category will likely add up to much more. However, the nice thing is that it’s gradual, and most of it is discretionary – and as I mentioned, I don’t mind the idea that our kids might feel a little deprived at times :)

Update two years in: We haven’t really felt the impact of this yet, as Annie doesn’t do any activities outside of school and doesn’t even always order her own meal when we eat out. But I know it’s coming!

Long-Term Expenses

Our final budget category brings us farther into the future: we’re talking large, long-term expenses like paying for private schooling, college, cars, and weddings. There’s no doubt about it: these can be BIG expenses, and it’s straight-up addition that you’ll shell out more the more children you have.

Our take: While this category will likely represent the largest portion of the budget when all is said and done, it did not loom largest for us when we considered the financial implications of having a third child. Yes, that’s in part because many of these costs seem far away when you’re still pregnant. But it’s also because they are far away, and we’re optimistic enough to believe that our track record of saving, investing, and living below our means will get us where we need to go when the time comes.

These costs also don’t spook us because we believe there’s lots of room to be judicious with spending (and creative!) within these categories. A new car for each child at 16? Not likely – but maybe we’ll agree to match whatever they save for a car purchase. College? Yes, we’d love to help send them if they choose to go, but also know that there are GREAT and less-expensive options than a four-year liberal arts degree at a private school. A wedding? Well, you know that one is my weakness :) But just as we were creative with our own wedding expenses, we’ll be ready to get creative with theirs – and expect them to contribute, just as we did once upon a time.

Bottom line: These costs are big – yes. But to us, they’d never be the deciding factor in whether or not to add a third child to the fam. Many of the costs are gradual, can be delayed, or are simply optional.

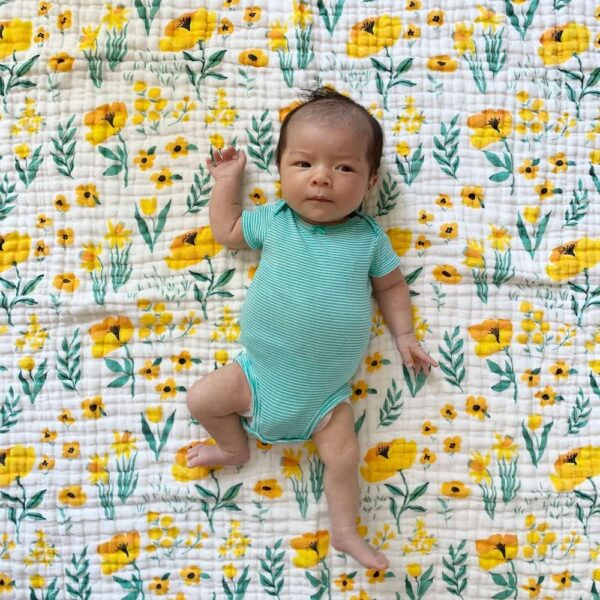

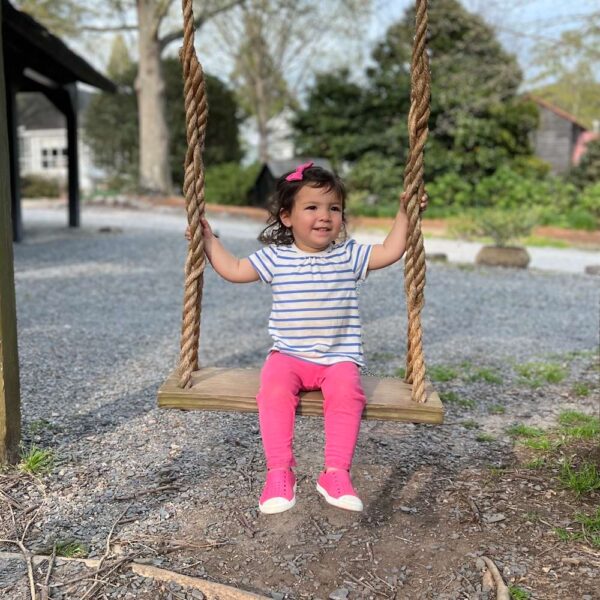

Update two years in: Here, here! Knowing the total joy our third child has brought us, I’m glad this was (and is) our perspective :) And here’s the photographic (almost) two-year update below!

I hope this was helpful, friends! I would really love to hear your thoughts and perspectives in the comments. And of course, though I’ve tried to consider many factors, it should be said that my conclusions here are drawn from our experience with our particular three children. There are many scenarios in which the financial implications for a third child (or any child) could be wildly different – I’m thinking specifically about those who have a child with a disability or extraordinary health needs.

Thanks, as always, for chiming in!

Affiliate links are used in this post!

I always learn so much from your money posts, Emily! Thanks for being so open and I loved the almost-two-year update with this one!

I’m so glad it was helpful, friend!!

Agreed, money and kids, so under-discussed. I don’t know how many times I’ve heard older adults say “Oh, you just figure it out!” when it comes to navigating financial issues and raising children. That’s not helpful at all. And it’s not easy to “just figure it out.” My daughter’s birth mom specifically listed financial struggles as one of the reasons she chose place her baby for adoption.

My husband and I do OK, considering we live in one of the most expensive places in the country. Right now, with just one toddler, we are feeling the squeeze of daycare and swim lessons. Swim is a non-negotiable since I grew up not knowing how to swim. I’d say the number 1 thing that helped us prepare financially for parenthood is the fact that our budget has mostly stayed the same over the last 8-10 years, even after getting raises and refinancing our mortgage down to a really low interest rate. Before becoming parents, the extra money we had after paying for the necessities went to traveling. Now, most of that cushion of cash is our daycare/kid fund, and I rely mostly on my skills as a “points hacker” to afford travel. :)

Agreed, Jewel! We tried to have the mindset that we didn’t necessarily know every reason why we’d want to preserve that cushion between what we made and what we spent, but that one day we’d be grateful we did. And we were right, ha!

I’m a longtime reader who loves your money and motherhood posts so was excited to read this. We live downtown in a high-cost-of-living city. For us family considerations are almost entirely about childcare costs, and wow am I jealous of your tuition. The only two full day daycares in our area cost over $4200/month for one infant. We’re so lucky to have a phenomenal, loving, safe, stable daycare option, but ouch… We did know that was the norm in our area, so we went in eyes wide open and just tell ourselves that this is good practice for future college costs!

In contrast, some other costs are not major considerations: most families have 2 bedroom apartments and all kids share the second bedroom. Likewise cars really aren’t as relevant for our life.

It is interesting how despite where we live, our lives look remarkably similar: close-knit neighborhood, walk to school and church, emphasis on playing outside and living a “slower” life. Always interesting how similar family decisions play out differently in a variety situations; thank you so much for sharing yours!

I love this comment so much, SG! Aside from the cost of daycare where you live – my eyes nearly popped out of my face, ha! I can remember my sisters-in-law talking about daycare in NYC/Jersey City and I think it was around 3k for them – but that was 8-ish years ago!

I love the idea of popping your trunk so June can hop out for carpool! Haha!

Three and a half years in to our third kiddo and I vividly remember the conversation David and I had when we actually processed through what a third child would mean for our family dynamics and finances. We land in a similar place regarding long-term expenses. While teaching doesn’t bring in the big bucks, I know we have stewarded the income we do have well and will continue to do so in hopes that we can assist our kids to some extent, but also fully expecting them to do their part. We also think there are really creative ways to handle those larger expenses. I am thinking of our own wedding where we actually did a potluck meal where all our friends and family brought a side, rather than catering. This saved us so much money and it was just the sweetest way to bring the folks we love most together.

Love this so very much, friend. So, so true!

Hi Em!

I’ve been following your blog since 2012. I was married the year after you, had a baby girl the year after you, had a baby boy the year after you, and just found out I’m expecting another baby girl in September :) Wow! What a joy it’s been to read your thoughts as someone one step ahead of me, gleaning wisdom and encouragement along the way. And uncanny the timing of our life events :)

This post was the most timely, and I loved reading, as always! xo

PS – our biggest dilemma right now is the rooming situation (we also have 4 rooms and need a guest room), so I’m encouraged to hear June is open to sharing a room with Annie down the road. Perhaps this will be a good route for us as well!

Katie!! This comment just makes me tickled! So, so fun and I’m so glad you’re here. Best of luck with the rest of your pregnancy!!

As always, I appreciate your honesty and openness. While I have not thought about having a third child as I only have one, finances and children was always a strong thought for me. We suffer from infertility and decided to try medical treatments which of course brings a lot of cost that most families don’t have to factor in. But it did give us our son so it was totally worth it. And now we are hoping to adopt which of course has its own unique costs. But I know that these expenses are a drop in the bucket of a lovely life. And I am grateful that we budgeted and planned our future with the flexibility to fund these unexpected bumps in the road.

Thinking of you, friend! Please keep us posted if you end up doing any fundraisers for your adoption – it takes a village! :)

I just want to give you a huge Thank You for this article. This was my first time reading your writing, but everything you touched on has been panicking me over the past few weeks. I am currently 14 weeks pregnant with our third with so many questions and most of the same conversations between my husband and I that you cover here. Childcare and transportation are our biggest concerns. But you really put it into perspective that cars can fit more of the right kinds of car seats, and daycare costs (our greatest anxiety) are only temporary. It really helped me feel a little more at ease tonight. Thank you!

Brittany! I’m so glad you found this post and that is was helpful. Thank you for taking the time to let me know it! :) Wishing you the biggest blessings in the next few months of pregnancy and welcoming your little one. Our third has been such a joy in our family’s life and I hope the same for you!

Update two more years down the road?