1 November 2017

If you’ve spent any amount of time around here, you know that one of my life mottos is “everything in moderation” (thanks, Dad!). In general, I think it’s healthier, more sustainable, and more enjoyable to stick to a middle road than lurch to an extreme.

But sometimes, if you’ve been indulging more than usual, keeping everything in moderation necessitates a brief period of fasting. On that note, you’ll see that one of my November goals is to abstain from dessert (except on two special days!). I’m feeling in need of a little reset, and hoping this will do the trick! Everything else I have planned should be a breeze compared to that :)

P.S. I love using the PowerSheets to track my professional goals (and sometimes personal ones, too). The new collection went on sale last week and it is awesome! The one year goal planners will likely sell out before the new year, so scoot over and get yours soon if you’d like one for 2018.

What I read in October:

— Red Rising (Re-read this one in preparation for reading the third book in the trilogy — it’s been a few years, and I wanted a character and plot refresh before diving in!)

— The Secret Keeper (Valerie’s recommendation – so good!)

— Books I’m reading throughout the year: The Power of a Praying Wife and The Lifegiving Home

Revisiting my goals for October:

Start my work-from-home days with Bill Hybel’s prayer journaling practice (So I actually only did this once… yikes. The weird thing is, though, it was notably moving and impactful that one day I did it! Definitely something I want to continue incorporating whenever I can.)

Have a magic eraser party all over our house (Yes! They really are magic!)

Re-color code book shelf (Yes! You can see a little peek here, but basically, instead of going in normal rainbow order I started with white on top, then blues and greens, then yellows and oranges, then reds, then blacks, to lighten the overall look up a little.)

Spruce up our bedroom dresser (Yes! Nothing really worth showing, but I streamlined it as much as possible and added a silver frame with a snap from our last session with Nancy.)

Organize our pantry (Going on the November list!)

Host the fifth annual pumpkins and soup party in our backyard (Yes! Post here.)

Come up with something fun for June’s Halloween costume! (See the shining light!)

November goals:

— Vote!

— Organize our pantry

— Cozy up our guest bedrooms and upstairs bathroom in prep for Christmas visitors

— Sort through all the “to be framed/hung” pieces in the loft and DO SOMETHING WITH THEM

— Find general practitioners for John and myself and make appointments

— Post gift guides before Black Friday (this is earlier than I usually do them, but if I’m recommending you front load your shopping on Black Friday, I figure I should give you my picks before then!)

— File all paperwork in blue room (I pretty much just dump any paperwork we need to keep on our guest room desk throughout the year — this will be my once-a-year filing session :))

— Abstain from dessert (except for the launch party and Thanksgiving)

— Start a life list book (something I’ve wanted to do for awhile – I love this idea so much! I’ll probably write about ours more once I get it started!)

Friends, I’d love to hear: What would you like to see in my gift guides? Who do you need suggestions for? What price point is most helpful? Right now I’m thinking of doing one for boys, one for girls, one for ladies, one for men, and a surprise category, plus my own personal wish list, but I’m open to suggestions! Maybe one for grandparents??

Affiliate links are used in this post!

31 October 2017

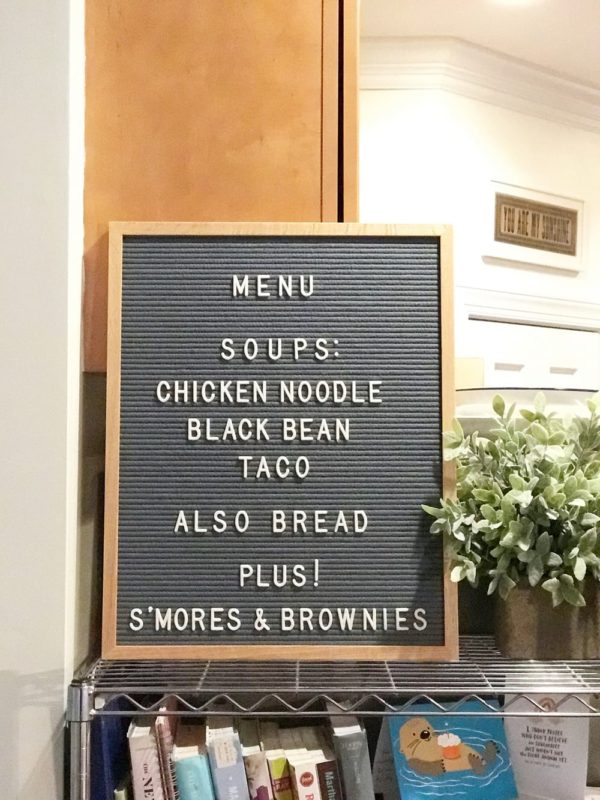

Happy Halloween, friends! Our fifth annual pumpkins and soup party was this weekend!

With the completion of our backyard renovation, we got a bit ambitious this year and opened up the guest list from three families to nine, for a total of 32 guests (though to be fair, several of them were infants). We got a bit nervous when every single person RSVP’d yes, but after a few last-minute drop-outs, managed to squeeze everyone in for a cozy evening :)

Thankfully the rain let up an hour before the party, and despite the gray and windy night we were left with, we were able to be outside for the pumpkin carving and s’more roasting, as planned. Our younger guests certainly weren’t afraid of the cold, and June had the best time chasing and being chased by the older kids!

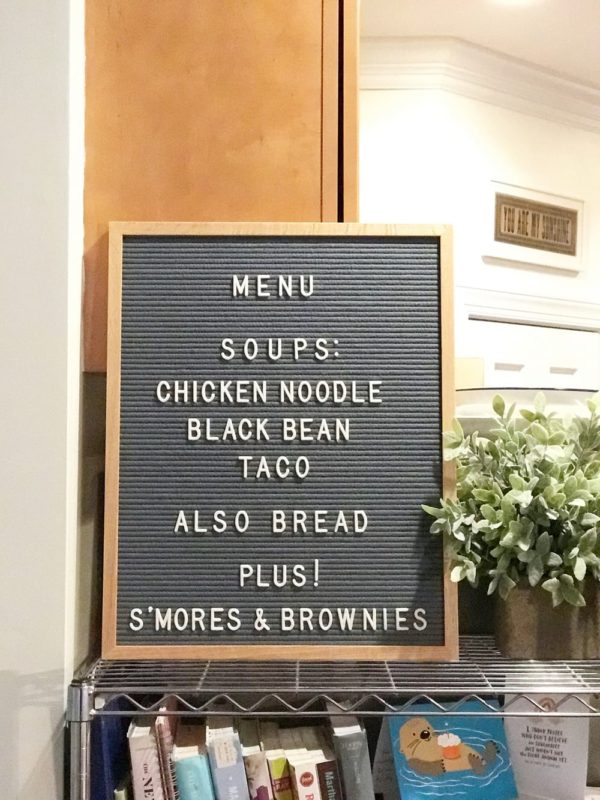

On the menu:

— Pigs in a blanket (my favorite!) and veggies and dip

— Hot apple cider plus various other drinks

— Chicken Noodle Soup

— Taco Soup

— Black Bean Soup

— Cornbread and bread from La Farm

— A pan of mac and cheese

— S’mores and raspberry brownies for dessert

The nice thing about holding an annual event is that you can stock up on supplies over time, and we made a few good additions this year, including the gray gingham tablecloth above, generously-enough sized to fit our dining room table with all the leaves in. (I thought the price point, and the quality for the price point, were both very good.) We also added these tools to our carving arsenal, as well as a pumpkin gutter!! (Totally recommended if you plan to carve every year!)

Since we had LOTS of little kids in attendance, we also set up a pumpkin painting station. (I just spread out a plastic tablecloth, washable paints, and paint brushes.) This was not as messy as I feared it would be :)

Though it was a great evening, we’re considering ratcheting back the guest list a bit next year — though I love each and every person we invited, I missed feeling like I got to talk with everyone who came, and big groups are not these introverts’ forte! On the other hand, I like that this is our “signature event” and a great opportunity to mix and mingle our different groups of friends. We shall see.

I’m curious: do you prefer hosting big parties, smaller groups (2-4 couples), or just one other family or couple at a time? And what are you being for Halloween, if you’re dressing up?? :)

Affiliate links are used in this post!

26 October 2017

One of my pet peeves about personal finance is when experts make blanket suggestions on how to save money. I think the way you spend (and save!) should be based on what you value. If you do this, you’ll not only find it easier to stick to your budget, but you’ll get greater pleasure out of the money you DO spend.

Though I dislike one-size-fits-all suggestions, I love being inspired by how others are finding ways to save. I asked six of my savviest friends for their favorite ways they shave their budgets, and added in a few myself — I hope they get your wheels turning!

Saving money on food:

I don’t eat meat during the week. I have a pretty consistent rotation of small and inexpensive meals that I eat for weekday lunches and dinners. Not only does it save me money, but I don’t get decision fatigue over deciding “what’s for dinner?” — Jess Metcalf, Content Manager and newly-engaged gal

We shop almost exclusively at Aldi, which cuts our grocery bill almost in half (compared to name-brand grocery stores). I make a dinner plan based on their weekly specials, which helps us eat in for the majority of the week with plenty of leftovers for lunches. — Samantha Ray, hair and makeup artist and blogger

Food spending has been a challenge for us (to put it lightly) but we’ve made significant progress by switching to getting vegetables from a CSA box and buying meat from Costco (organic meat at normal prices). We get the box twice a month and plan our meals based on what vegetables we receive. This has challenged us to think outside our recipe box/cookbooks and has significantly cut down on the number of ingredients we buy per recipe. — Dave Kirk, finance guy and husband

I can’t even imagine how much we’ve saved over the years by almost never buying alcohol. We don’t hate drinking, but it’s just not something that’s important to us, and therefore doesn’t make sense for us to spend money on! – Em

I use cash and a calculator at the grocery store! It’s our foolproof way to not blow the grocery budget. — Valerie Keinsley, stay at home mama and online stationery shop owner

Saving money on entertainment:

I solely order water at restaurants, unless I’m celebrating something, in which case I’ll treat myself to a glass of wine or a cocktail. My mother used to own a restaurant, so I know the markup on sodas and my beloved sweet tea, and I consistently choose water instead. Unless I’m at Merritt’s, in which case, a glass bottle Cheerwine is calling my name! — Jess

We haven’t had cable for a few years after switching to an HD antenna (works for football and the Bachelor franchise) and Netflix. We recently cut Netflix as well, because you can only re-watch The Office so many times. We’ve replaced watching TV with porch date nights and reading before bed. — Dave

I stopped buying books on Amazon, and I wait for library books now. It’s an exercise in patience, especially for popular titles, but I’m saving money and learning my bookshelves. — Jess

Saving money in your relationships:

We have gotten creative with ideas on how to spend quality time together without dropping so much dough – things such as trying out a new recipe at home, sitting on the porch swing with a bottle of wine, or going out for a beer at a new brewery. These all cost around $10, which enables us to have more date nights since we aren’t dropping $50+ on a dinner out. — Elizabeth Burns, eCommerce gal and house flipper

My love language is gift giving, and I save a ton of money by shopping at the Dollar Tree for all my wrapping paper, tissue paper, and extra giftable goodies like candy, small personal care items, cards, and balloons. — Samantha

Since having our son, we’ve realized how expensive getting a babysitter AND going out to eat is, so now, most of our “date nights” are on our porch with a bottle of wine. It gets us out of the house (if only to the outside of our house), and the only thing we’re buying is a $6 bottle of Trader Joe’s wine, rather than spending $25-30 on a bottle at a restaurant. But, my city-loving wife would be crushed if that’s all we did, so we also plan out special monthly date nights when we do hire a babysitter and actually head out. Scheduling them once a month gives us something really fun to look forward to, and keeps us from being tempted to go out on a whim and spend more than we had planned. — Dave

Since having June, we’ve been very open to borrowing, buying secondhand, or accepting hand-me-downs whenever possible. I think sometimes, especially if folks plan to have multiple kids, they justify buying everything new, but we’ve found it’s just as easy to swap back and forth with friends. We’ve borrowed clothes, a crib, a bathtub, a hiking pack, and so much more! – Em

Saving money on your home:

Target is my budget Kryptonite. I go in for toothpaste and come out with a new duvet, kitchen canisters, boots, and no toothpaste. One thing that has helped me save money is that instead of going into a Target for basics like toiletries, cleaning supplies, pet products, and some food items, I signed up for Target subscriptions. I can have all of these everyday items delivered to my house regularly (free delivery!) and subscription items are discounted by an additional 5%. This way I can still get my favorite Target items without having to actually go into a store and potentially blow my budget on all of the cute stuff I don’t need. — Elizabeth

When our grocery store offers 4x the fuel points on gift cards, we buy gift cards for upcoming projects/gifts – i.e. if we’re planning a home project, we get a gift card to Lowe’s in the amount we budgeted for the project. That way we earn 4x the points, and often get up to $1 off per gallon of gas! It takes some planning, but is well worth it in the end. — Valerie

Many products come in a generic brand version, a refurbished version, or a lightly-used version that’s practically the same for a fraction of the cost. You can often buy floor models for a highly discounted price, too, which we’ve been doing a lot recently as we furnish our new home. And remember, almost everything in life is negotiable – you’ll never know if you don’t at least ask! :) — Robyn Van Dyke, photographer, blogger, and co-owner of a dental practice (with her husband!)

We utilize the Habitat Restore. Since flipping houses is one of our side hustles, we visit the Restore often for anything from exterior doors, shutters, furniture, lighting, and faucets. A lot of big box stores will give donations so you can buy new items for a fraction of the cost while contributing to a good cause. There are also neat antique finds like gorgeous vintage chandeliers and clawfoot tubs. It’s definitely worth checking out if you are sprucing up your home on a budget! – Elizabeth

Saving money on purchases:

Starting around the midpoint of the year, I begin hoarding planned purchases like a fevered squirrel until I unleash them all on Black Friday/Cyber Monday. I keep a list of things I’d like to buy and that might go sale (so far this year’s includes Winter Water Factory dresses for June, her Salt Water Sandals for next year, and Walk in Love tees for the family for next Valentine’s Day). I also, of course, include as many Christmas gifts as I can! To make so many purchases in one weekend is always a bit of a shock to my system, but it’s totally worth it for the savings. – Em

ReceiptPal! My husband found this app where you take photos of your receipts and earn cash back for them, redeemable as gift cards (including Amazon!). We’ve earned over $100 in Amazon gift cards, which we then use for household purchases to save money. He spends roughly 10 minutes a week putting in receipts. It’s slow going — you usually only earn a gift card every four months or so — but totally worth it. — Valerie

Whenever we need or want to buy anything, we wait. This does two things: it gives us time to consider if we really need or want it, and it gives us time to find the best deal. Almost everything has a sale or coupon — it’s just a matter of waiting until the sale, googling for coupons, or even buying a coupon on Ebay! Better yet, wait for the sale AND stack the coupon AND use Ebates! — Robyn

We use a credit card with 2% cash back for almost every purchase, and pay it off twice a month, every single month. I know this might be controversial to some, but for us it’s a no-brainer. We’ve earned hundreds of dollars over the years this way! – Em

Saving money on everything else:

This has been a hard lesson to come by this year, but we’ve learned there are no “sacred cows” in our budget. To accomplish our savings goals, we’ve had to take a hard look at every single budget line and readjust our perspective (and add a heaping dose of contentment and gratitude). We might not be traveling to an international destination every third year like we had hoped, for example, but we still get to spend a week with our beloved families on the beautiful Connecticut shoreline. – Em

We worked to get the “big three” — house, car, and education — right. If you choose to buy these three things below (or well below, or not at all) your means and be content, you’ll have so much more financial margin and freedom. Our first home was tiny and it was subsidized by a non-profit for $115K, and then we recently purchased our current fixer-upper home after lots of negotiation for $200K. Our first car was $5K, and we were a one-car family for a couple years until we bought two new Toyotas for a killer deal by negotiating in cash and utilizing the TrueCar App. Education is a bit harder since much of it is outside our control, but we both chose to go to an in-state university and applied for as many scholarships and grants as we could. — Robyn

I get my hair cut twice a year, and I just get it cut – no dyeing, no fancy treatments. I LOVE my stylist, but she is quite expensive, so I compromise by extending my cut as much as I can. – Em

We keep our recurring bills low and cut where possible. We’ve never had a car payment and we’ve also never had cable. We also have never had an individual phone plan, because it’s so much more cost effective to add lines to an existing plan with a sibling, parent, cousin, or friend. You all save, so it’s a win-win! — Robyn

One big way we save money is by make a monthly budget and using cash only for things like groceries, gas, and household items. It is totally worth the extra time, intentional conversation, and planning – I’d say it has improved our marriage as much as our savings! — Samantha

We intentionally fill our evenings and weekends with everyday adventures so that we’re not tempted to mindlessly browse – either in a brick and mortar or online. I only go to a mall with a specific mission, and being outdoors and together helps keep us grateful, content, and in awe of the world around us. – Em

Friends, please join the conversation: I would LOVE to hear your favorite ways to save money! And thanks to all of the folks above for sharing their wisdom! :)

Affiliate links are used in this post!

19 October 2017

Here’s something I bet you didn’t expect me to post about today: how marvelous the clothing is at Abercrombie & Fitch right now!

I had heard rumblings of A&F’s newfound awesomeness from a few friends, and sure enough, the rumors were true. After a quick browsing session, I checked out with seven items in my cart, and ended up keeping six!! Unprecedented! Here’s what made it into my closet:

All blue (I guess I know what I like?), but not a one with the A&F logo on it :) I did actually buy the bottom right shirt in white, but the detail was too hard to see in the collage!

Overall, I was super impressed with the quality of the fabric and construction — honestly, I felt like it was significantly better than J.Crew Factory, which constitutes the majority of my closet! Here are a few more detailed reviews, from top to bottom and left to right:

Knit wrap dress: Hands-down my favorite pick from this order – I’m a little obsessed and considering buying it in another color!! I’ve always loved the look of wrap dresses (so balletic!) but have never found one that fits me well. This one, however, is a dream.

V-neck sweater: Particularly impressed with the quality on this piece – it’s a lovely, heavy knit. I bought it in a medium so it would be oversized, and it’s just on the verge of being too big – but I expect it might shrink a bit over time.

Relaxed v-neck tee: A pretty basic at an incredible price. I will be buying this in another color!

Tie sleeve shirt: A casual but “grown up” look with a great fit. I love the stripe version, too.

Ruffle-hem top: Love, love, love this one. Thin but not see-through, and so soft. The first thing I pull from my closet after doing laundry :)

Ruffle sleeve boyfriend tee: I have had limited success pulling off the ruffle trend, but the ruffles here are understated enough, and the fit of the shirt boxy enough, that it works for me here!

And there was so much else I would happily have bought!! Like these comfy leggings! And this cozy pullover! But, you know, budget :) Though since I bought everything at 40-60% off, the prices couldn’t have been more reasonable.

What do you think, friends? Have you popped into an A&F recently? Are my picks convincing you you might need to make a visit? And do you regularly pack a shopping cart with only one color??

Affiliate links are used in this post!