30 January 2017

We are not perfect for each other, we are growing perfect together.

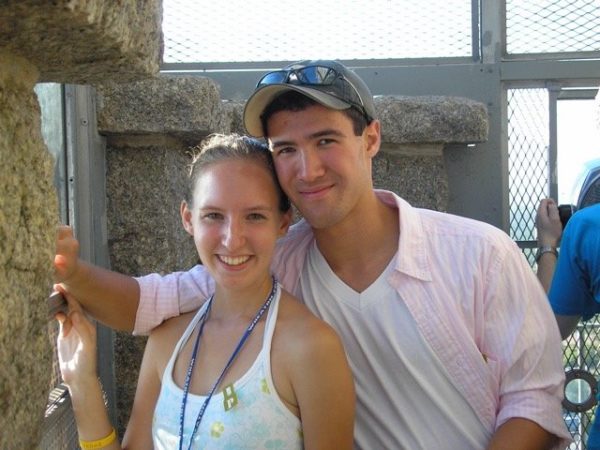

Though John and I have always had in common that which is most important to us — what C.S. Lewis called the “secret thread” – I think there’s something else that’s helped keep us together for twelve years, and that is that we’ve committed to growing towards each other. Towards each other, not away from each other, and not just side by side.

In Tim Keller’s book “The Meaning of Marriage,” he quotes Stanley Hauerwas:

I think this is very true. I wouldn’t necessarily describe John as a “stranger,” but we’ve both changed in the twelve years we’ve been together (see here for one example). This is inevitable: if you’re with someone for any period of time, they will change. You can either fight this, ignore it, or embrace it. (I happen to think high school sweethearts have a leg up on everyone else, because when you start dating when you’re 17, you KNOW you’re going to change!)

Tim Keller goes on to write:

When you inevitably change, you have the choice of growing toward your partner or away from him. At every juncture, we’ve tried to grow toward each other, though always imperfectly, and it has led to joy and beauty we never would have known had we dug our heels in.

We are not perfect for each other, but we are committed to perfecting each other… and that makes us perfect for each other.

P.S. I just made a new category here on EFM: love + marriage. If you’d like to read more of my musings on our relationship, that’s where you can find them :)

27 January 2017

It might just become your new favorite, too.

I’m not sure what made me think of Elvis one day, because I can’t say I’ve historically been a connoisseur of his music. But I did… and it was an instant hit with Miss June. To be fair, she gets very excited whenever we put on music, but she does seem to love Elvis even more than our Disney playlist, the Beach Boys, big band favorites, Cozy Fall, our cooking playlist, and Christian Folk, which comprise the other standard options at our house.

Click here to listen, if you like – I chose some of his most upbeat options for this highly-curated collection. And I challenge you to not have your own kitchen dance party when you do! :)

Happy weekend, friends!

25 January 2017

Though we are still using and loving many of the baby items I’ve posted about since June was born, I thought her first birthday was a good opportunity to share a few of the things making our days easier and more enjoyable right now! Something you won’t see on this list? Toys! While June has a few in her collection, none of them seem to capture her interest as much as run-of-the-mill household items, including but not limited to magnets, K-cups, pens, tubes of lotion, sunglasses, and remotes. There is NOTHING cooler than a remote, let me tell you…

— Now that June has a considerable amount of hair, this soft brush comes in handy for taming it.

— Up until a few weeks ago, we were using an old iPhone for white noise. The speaker finally gave out (as we were warned it would), and so we replaced it with this slim-lined, unobtrusive white noise machine. A+ purchase!

— There are tons of options for diaper rash ointment out there, but we’ve had good luck with this one.

— Alexa! I have plans to write a separate post about technology in the home, but let me just say: I was very against getting an Echo, but after having her for a few months, I am enthusiastically on board. We listen to music way more often (pretty much all the time!), which our whole family loves.

— Again, there are lots of sippy cups to choose from, but we’ve liked these ones. By the way, it’s a strange task to try to teach someone how to drink from a cup, but apparently our methods worked because June drinks like a champ these days! She also LOVES to slam the cup back down on her tray after every sip :)

— It’s not a literary masterpiece, but June is getting way more into books these days and Zoom Zoom Baby as well as other lift-the-flap titles are some of her favorites.

— I love Freshly Picked as much as the next gal, but at less than half the price, these rose gold moccs are an awesome alternative. A very happy birthday gift from a dear friend!

— Now that June is sleeping upstairs, we’re using the Amcrest camera and app to keep an eye on her. It’s a good price point for a monitor and we’ve been happy with it.

— Now that June has more hair, the thin headbands from Simple June are some of our favorites. Once she has even MORE hair, I’m looking forward to putting the thicker ones from Amalie Maren back in our rotation! Right now, they just look a little funny :)

Mamas, would love to hear a few of your favorites for this age!

P.S. Favorites from the first six weeks, five months, and eight months.

23 January 2017

Two years ago, I wrote a Marvelous Money post about preparing financially for a baby. I did not, in fact, have a baby at the time, and so I took great pains to tell you to take my advice with a grain of salt. I also promised to revisit the topic at some point in the future. Today I wanted to touch on one aspect of our financial life post-baby, and I hope there will be more to come in the future. And good news! Whether or not you have kids (or ever plan to), I think you’ll find this post helpful, because it centers around what I feel is one of the most important personal finance topics to truly take to heart: trade-offs.

In preparing our 2017 budget, we decided to cancel the trip we’d planned to take to the Southwest this year.

Here’s the thing: we have the money to take this trip. It’s sitting in our bank account. But, because we also have the Very Big Goal of paying off our mortgage in the next five years, we are choosing not to take it.

(Why am I connecting these extra mortgage payments to our foregone vacation instead of, say, our extremely expensive childcare? Because we were able to take more expensive vacations and still make extra payments before we had June, it might seem to make more sense to “blame” our childcare costs for this trip cancellation. But, because childcare is a must-do, and the extra payments are something we’re choosing to do, to me it seems like the payments are squeezing out the vacation.)

Were we disappointed when we decided to postpone this trip? Yes. But, it’s hard to feel disappointed when I think about all of the marvelous adventures we’re still going to have this year. We’re going to spend ten days on an Island in Maine with my family. We’re going to use the week we would have been in the Southwest to travel to Michigan with John’s family, a trip that will cost less than $1,000 compared to the $4,500 we were estimating for the Southwest. We’re going to take two long weekend 30th birthday trips (more about those soon!). And, as I shared in my 2017 goals, we’re going to have lots of fun right where we are, having everyday adventures close to home that cost next to nothing.

I think it’s very important to carefully consider your trade offs, and make them ones you can live with. We are sacrificing a lot in the hopes of paying off our mortgage more than 20 years early – fancier vacations, new cars, clothing, going out to eat, home purchases, etc. We know that the freedom we’ll have when we own our home outright – and the cash flow we’ll have in our budget once we’re not making a monthly mortgage payment plus more every month – will be more than worth the sacrifices we’re making now.

But we also knew the trade off wouldn’t be worth it if we were miserable for eight years, living in a holding pattern, eating peanut butter and jelly every night, and never spending anything but the absolute minimum. So, we still go on vacation. We still eat out. Though compared to some of our peers we might be scrimping and saving, by many people’s measure we are living high on the hog — and that’s how we choose to see it. We feel immensely lucky to do all the fun things we get to do while still being able to save so much for our Big Goal.

Do you have a big goal, too? Paying off your student loans? Building an emergency fund? Buying a car? Saving for a down payment or an adoption? Maybe you want to pay off your mortgage, too? I’d encourage you to look at the trade offs you’re currently making, and see whether you can make any changes to both save more money AND have more fun. I truly think it’s possible, but it might take a mindset shift even more than a change in behavior. As Tony Robbins said, start rich.

I’m cheering you on!! And I’d love to hear – what big financial goal are you working toward now? What trade-offs are you making to get there?