10 September 2013

I have a favorite pair of shoes. They’re from Target, and I’ve had them for about seven years now. They’re a shade in between black and brown that goes with everything, they have low heels so they’re comfortable to walk in, and they have a pointed toe that looks polished but doesn’t pinch. Perfection! Except for the fact that the heels have been completely ground down over the years, leaving only the head of a nail poking out. I’ve tried to replace them with a similar pair several times, but never found a fit or look I loved.

Eventually, it occurred to me that I might be able to have the heels replaced. I wasn’t even sure if cobblers still existed (turns out they do), and I thought that even if they did, they’d probably think I was crazy for wanting to fix a beat up pair of Target shoes, but I figured it was worth a shot. A quick search on Yelp turned up a highly-rated shop (H&H in Cameron Village, for my local peeps). I explained to the man behind the counter what I wanted, and he promised they’d be ready in three days. And they were! I picked them up the next week, and for $11.30, I had a greatly improved pair of heels. Don’t get me wrong, they’re still seven-year-old shoes, but I’m no longer embarrassed when I flash the soles, and I don’t go clickety clack whenever I walk.

Fixing something I already own and love instead of spending time and money searching for something I might love less? That’s a major win in my book. Have y’all ever visited a cobbler? Do you have a seven-year-old pair of shoes you adore?

P.S. The next shoe adventure in store? I really want to dye my white wedding shoes black, but am clueless on where to start.

9 September 2013

Hello, friends! John and I had a weekend filled with some of our favorite things — friends, family, and weddings! One of our dearest friends — we went to both high school and college with her — got married on Saturday, and John and I were honored to read at the ceremony. It was a quick trip (we flew up Saturday morning and back last night), but we still managed to have breakfast with friends and lunch with our parents in between wedding festivities.

Instagram from Bryce Covey, the photographer!

John and I have always known how lucky we are to have such a close group of friends from high school, but goodness, this weekend really hammered that home. Things have changed — five of our original eleven are now married, one is engaged, and two more are on that path — but it’s amazing how much has stayed the same, including our ability to laugh over the most ridiculous things. We’re scattered across six states, with two on the West Coast, so its a huge blessing whenever we can all get together, and even more so how easily we fall back in step with each other when we do.

The wedding ceremony was my favorite kind — carefully considered, meaningful, serious, and joyful — and as I said, we were honored to play a role. My favorite part, though, was the congregational affirmation:

We have witnessed the marriage of Jackie and George. They have made their vows in our presence and asked for our support in their life together. We also have the honor of affirming our commitment to them. I invite you to uphold Jackie and George in their promises by responding to the following questions:

Do you commit yourself to providing all the encouragement and support possible to help Jackie and George in their marriage?

Do you agree to do all in your power to assist Jackie and George in the struggles they may encounter?

Do you give yourself to the ideal of living out a life of commitment, that Jackie and George may see in you an icon of what they seek?

If so, answer, WE WILL.

I was struck once again by the power of a marriage ceremony — what it means for the two people being joined together, but also by the commitment it requires of everyone who participates as a witness. Maybe it’s because we’re just a week out from our own first anniversary, but I was really touched by the depth of that promise. What a beautiful and joyful way of linking so many lives together!

Also from Bryce

Are you still close with your friends from high school? If you’re married, did you include a congregational affirmation in your ceremony? I’d love to hear!!

30 August 2013

Welcome back to Marvelous Money! We appear to have taken a bit of a summer hiatus, but we’ll just call that time to let the first seven posts sink in. (Missed one? You can find them all here.) So far we’ve covered emergency funds, managing joint finances, building a budget, and yes, how to spend money :) Now, it’s time to talk retirement.

Before we get into the nitty gritty, though, I thought it might be worthwhile to spend a bit of time on the WHY. Or, perhaps more importantly, the why NOW.

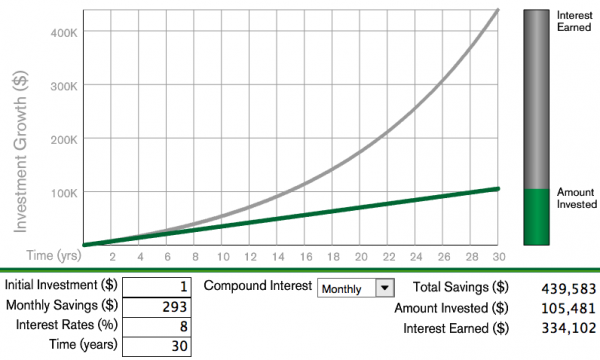

Because yes, everyone knows that theoretically they should be saving for retirement. But are you? I’m betting that if you see the reality of what starting now versus starting in ten years means for your future, you will indeed be motivated to take action. If you’re reading this in your twenties or thirties, you have an insane amount of power in your hand, and it’s called compound interest.

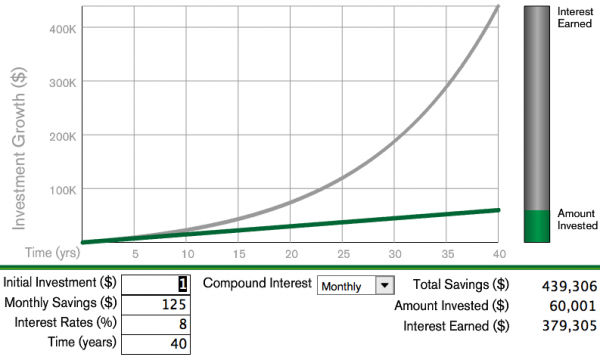

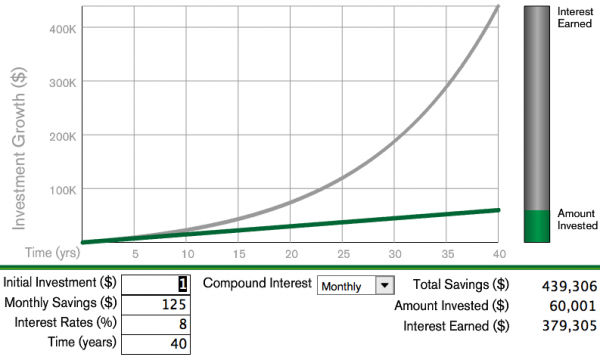

Let’s look at a few numbers. Let’s say you start saving for retirement at age 25. You put away $125 a month, and you earn an 8% average every year (around the average annual historical return of a balanced portfolio of stocks and bonds). After 40 years, at age 65, you have about $439k. Marvelous!

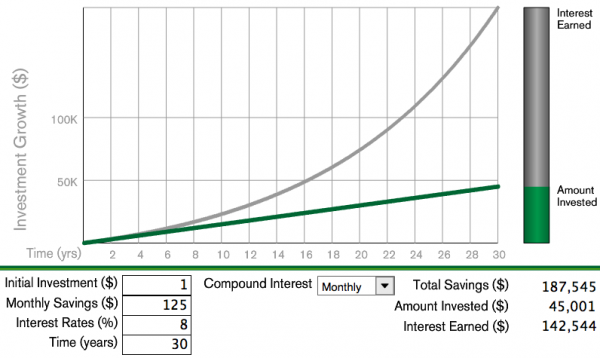

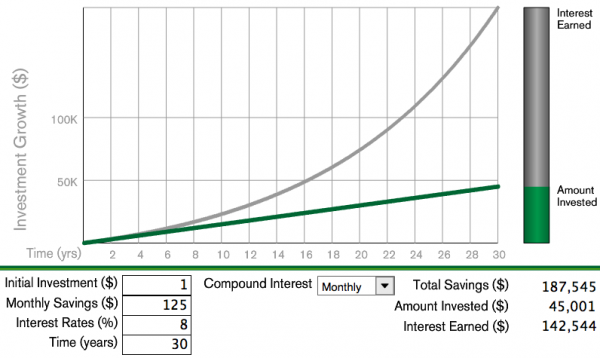

Now, let’s say you start saving $125 ten years later, at age 35, with the same return. At 65, you have about $187k.

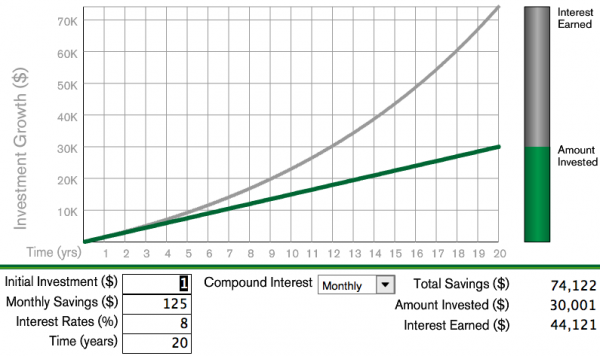

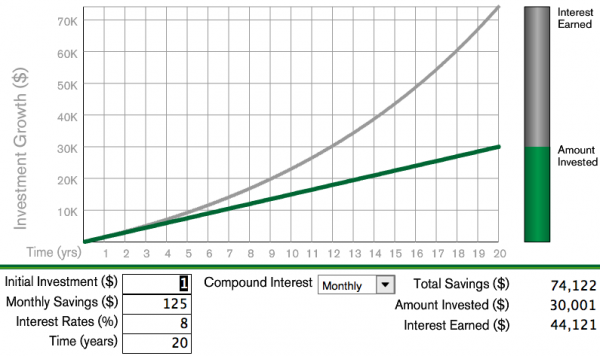

Let’s go one step further, starting at age 45 and saving $125 a month. At 65, you’ll have just $74k. Yipes!

Obviously, if you start saving later in life, you’d probably save more per month — if you can. But WE want to make our money work for us, don’t we? And I don’t know about you, but I think the demands on my money are only going to grow as I get older.

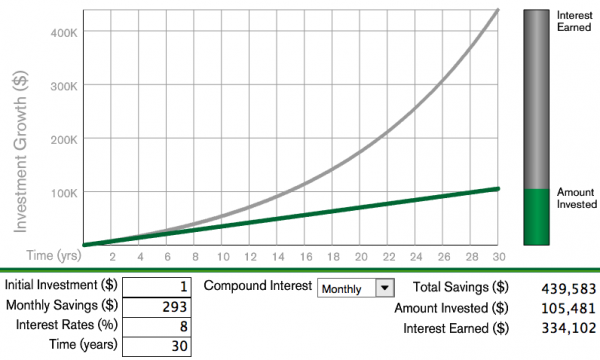

To go back to our example for a moment, let’s say you start saving for retirement at age 35 but want to end up with the same amount of money at 65 as the peeps who started at 25. To start ten years later, you’d have to save MORE THAN DOUBLE the amount per month — $293 versus $125.

This gets at the question I pose in the title of this post: Why save for retirement? Fully funding your retirement means setting yourself up for financial independence. Not only will you have more flexibility later in life (when to retire, etc.), you’ll have more freedom throughout your life, as you need to save less money to reach the same goal.

Just one more example. Imagine you’re given two options: you can have one million dollars today, or a penny that doubles in value every day for a month. Which do you take? If you take the penny, after the first ten days you’ll have $5.12. Not too exciting. After 20 days, you’ll have $5,242.88, which is better, but still nowhere near one million. BUT WAIT, there’s more — by day 28, you’ve surpassed the first option with $1.34 million, and on day 30, you have $5,368,709.12. Marvelous, indeed!

The lesson? You can’t skip the boring part — and I guarantee saving for retirement might look boring for awhile. But the boring part? That’s your ticket to the exciting part, where your money truly starts working for you. The most growth comes at the very end.

So, here we are. You have to start. Time is the most powerful part of this equation, and it’s the ONLY part you can never make up. I know that there are lots of demands on your money, and maybe $125 a month seems like a lot right now. However, if you read this blog, I would be willing to bet that you’ve been spending $125 per month on something discretionary that you could redirect toward retirement savings. Fun? Nope, not always. But I don’t expect anyone to hand me my retirement, and I don’t think you should, either. As my Dave Ramsey friends like to say, if you will live like no one else, later you can live like no one else. And that’s the truth.

Much more to come on this topic in the coming weeks, but in the meantime, I would LOVE to hear from you. Where are you right now with retirement savings? Do you have a 401k or IRA? Do you contribute a set amount per month or year? Do you feel good about where you are? This will be super helpful as I plan future posts, so please chime in, friends!!

P.S. Since I’m asking you to share, I should, too: I opened my first IRA at age 19 (traditional) and opened a Roth a few years later. I’ve contributed a bit less than $125 per month over the last few years since we were focused on debt reduction, but the big goal for 2014 is to fully fund! More on all this soon!

29 August 2013

We hung our gallery wall! Hooray! And we’re really pleased with how it turned out! But before I share it with you (though you’ll see a little peek here), I wanted to finish up another post that’s been sitting in draft for awhile.

We decided when we moved in that we didn’t want to jump into any big purchasing or decorating decisions — especially expensive ones — immediately, as we thought it’d be wiser to live in the house for a bit and see how we naturally used the space. I’m glad we made this decision. Very quickly, however, it became apparent that our first big purchase would need to be a rug for the living room area. We love the wood floors throughout the downstairs, but without any soft surfaces of any kind underfoot, the overall effect was pretty cold. Plus, I don’t think our cats approved :) We also wanted a large area rug to anchor the seating area and set it apart from the adjacent dining area.

So, the search began! I virtually visited all the usual haunts, including Pottery Barn, Crate & Barrel, Wisteria, Serena & Lily, World Market, Restoration Hardware, Lulu & Georgia, Overstock, Rugs USA, Ikea, eSaleRugs, and Layla Grace. One tip: Make sure to look at the baby, child, or teen version of a store, if one exists (like PB Teen or RH Baby & Child) — they often have lovely, cheaper designs!

Complicating the search a bit was the fact that I was kind of shopping for two rugs, even though we only had plans to buy one at the time. We are probably going to buy a rug for under the dining room table at some point down the road, and because the spaces are so close, I want the rugs to work together well. As an aside, this issue has actually come up a lot as I think through choices for this space, from lighting to curtains — it’s really like decorating one giant room in three parts as opposed to one room or three distinct rooms.

We would eventually like some sort of vintage Turkish/Oriental rug (kind of like this) for under the dining room table (all of those colors will help hide spills!), so I honed in on something simpler for the living room. I tried to keep my mind open and my search wide, so we ended up with options in several of the colors in our palette — which, coincidentally, is pretty much the same palette as this blog. I know what I like. More on that later.

Here are just a few of the options we considered:

A. Overstock, B. Layla Grace, C. Shades of Light, D. RH Baby & Child, E. Shades of Light, F. Overstock, G. Layla Grace, H. RH Baby & Child, I. Shades of Light, J. Shades of Light, K. Rugs USA, L. PB Teen, M. Rugs USA, N. Overstock, O. Rugs USA, P. Rugs USA, Q. Shades of Light, R. Overstock

This was such a hard decision, friends!! If we hadn’t had a deadline (see below), I think we probably would have been hemming and hawing still. A rug is visually such a large part of a room, and such a large investment, that we wanted to get it 100% right. Yes, you can return a rug, but shipping can get very pricy, and you often have to pay a restocking fee. We spent our time on this decision not because we’re overly concerned with how our house looks (I don’t think), but because, as with every other purchase we make, we wanted to be sure we were spending our money wisely on something we would love for years to come. We are trying to be good stewards of what we’ve been given.

We finally decided on the Surya Frontier Pale Blue Hand Woven Wool rug from Layla Grace, and I’d say we got it 90% right.* I’m particularly proud of the price — we pounced on a 40% off sale over the Fourth of July, and got free shipping, too! Our 8×11 rug was less than $500. (Dina posted about purchasing a rug for 75% off from Rugs USA over July 4th, so I made sure to sign up for all possible store emails and be ready with our decision in advance! Highly recommended!)

Before:

And after:

Anyone else purchase a rug recently? Did you find it as nerve wracking as I did??

*Though we are very happy with the look, I’m taking 10% off because it’s not as soft as I had hoped (duh, it’s wool). We don’t get down on the floor too much in this stage of our life, but I imagine it wouldn’t be the most comfortable for kiddos in the future.